Turn payments into a competitive advantage.

Client Case Study

Net new annual

revenue

Unlike other providers,

no impact to chargebacks

Increase in

approval rates

Proven Against the Competition

We went head-to-head optimizing subscription billing authorization rates for a shared multinational digital-gaming merchant.

We outperformed the other provider with a 7% increase in approval rates.

While the competitor’s solution meets industry standards, we discovered major processing flaws in their solution which resulted in massive increases in chargebacks.

Source: Internal and client provided data

Intelligent transaction optimization for seamless customer experiences.

We work with you to better understand transaction trends and employ machine learning, ensuring your customers have the best experience while growing your bottom line.

- Data Science: Identify trends and patterns in your transaction leading to better approval rates and enhanced payment strategies.

- Rules Engine: Best-in-class machine learning and AI to recoup and prevent declines powered by transaction and network research and consumer behaviors, all while taking issuer-specific rules into account.

- Card Account Updater: Securely update card-on-file and recurring payments with the most recent account information, in real-time.

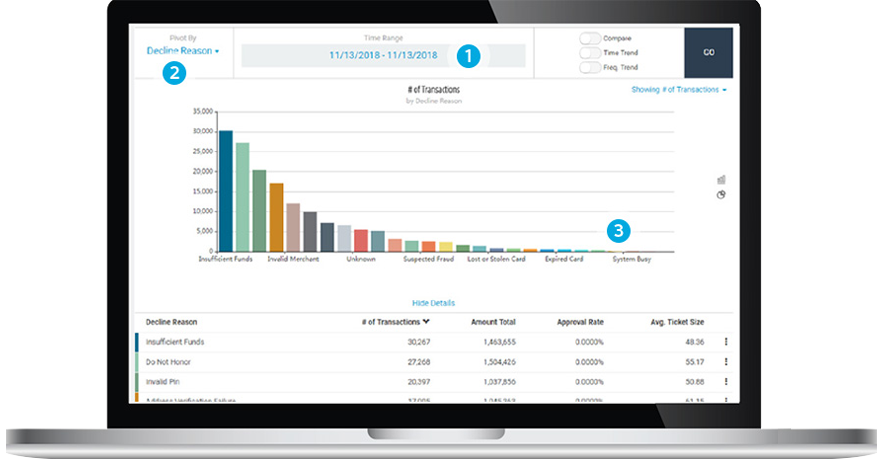

Better data insights and real-time decisions

Enterprise Insights is a near-real-time, on demand data analytics platform that enables you to view and manage key aspects of your business operations. This platform gives you the flexibility to visually interpret and analyze your transactional data and gain detailed insights into your stores and customers.