Increase Profits with Payout Solutions

Save time and money with a comprehensive digital payout solution that helps eliminate 60% of related business operating costs and reduces onboarding time.1 We disburse over $800M payouts a month via exclusive disbursement options and direct top-tier bank connections.2

Offer More Digital Payout and Pay-In Options

Provide your customers and employees unmatched choice by offering exclusive digital payout and pay-in options across the U.S. and Europe. Leverage our direct connections and extensive partnerships with top-tier banks.

Debit Card

Prepaid Card or Money Network

Digital Wallet

Social Payment

ACH or PDF Check

Innovative Experiences Across Industries

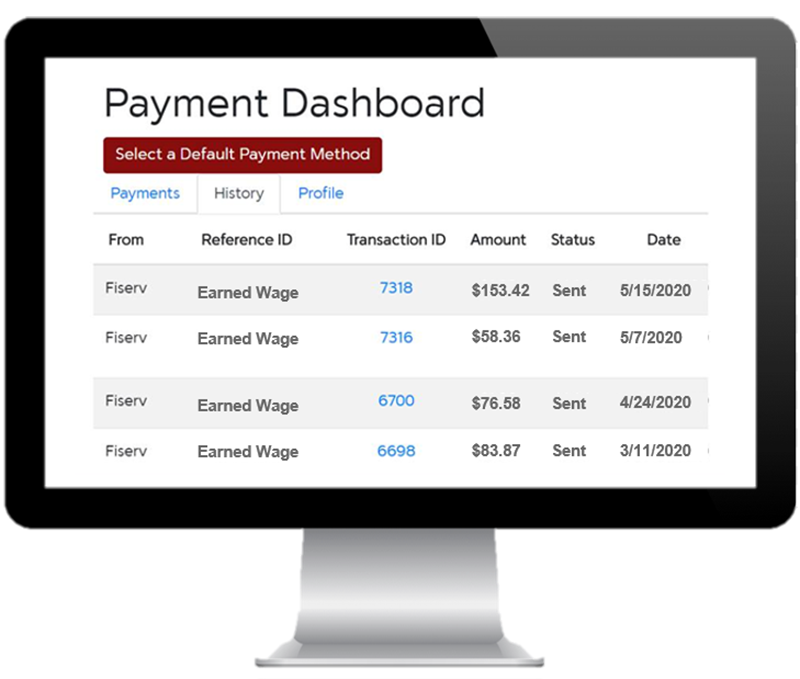

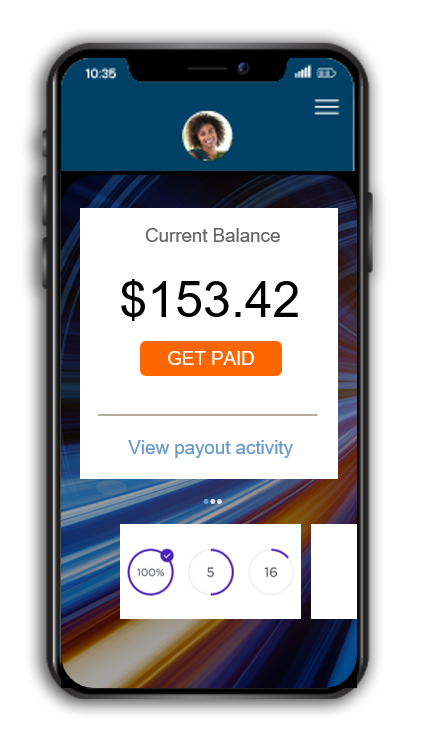

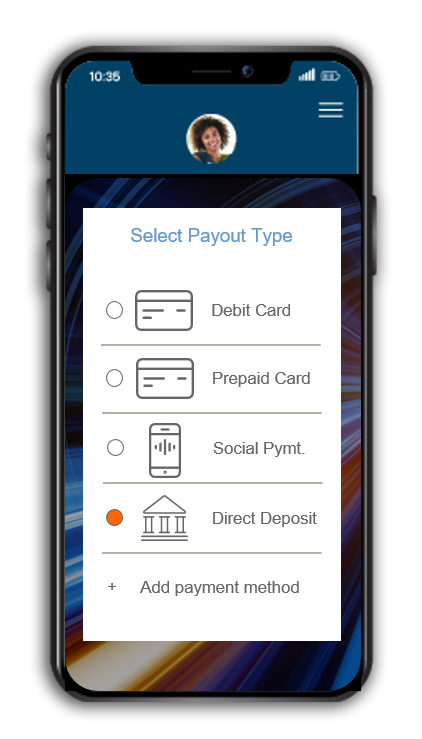

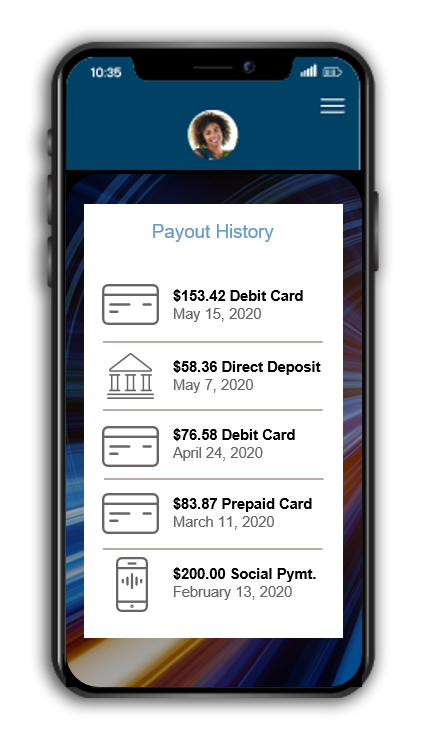

Create Seamless User Experiences

Let your customers or employees pull down earned funds quickly and easily in five seconds or less.2 Leverage our technology to improve your mobile or portal payout experience for single or mass payouts - including weekends, holidays and after hours.

Profit from Consumer Preferences

Instant access to funds is a part of bonding with consumers for the new normal. Technology and consumer demand have permanently accelerated digital payment adoption.

Less expensive than traditional checks and wires1

Consumer Demand for Digital Payments

44

%Of U.S. customers are willing to pay for an instant payout4

70

%Of U.S. consumers prefer instant payouts4

25

%Reduction in payment status inquiries5

Versatile Digital Disbursements Results

We help create excellent disbursement experiences for insurance claims, gig economy wages, gaming winnings, government funds and more. Learn about some results from a few of these industries below.

- US Treasury Success Story

- Gig Economy Success Story

- QSR Success Story

Informant Payouts at 50% Direct to Debit

By integrating into our electronic disbursements portal, the US federal agency and US Treasury could disburse funds in real-time.

Recipients could receive funds by selecting from their preferred payout options.

Source: Fiserv and client-provided data.

Developer-Friendly, Flexible Integrations

Send payouts through the most popular channels to multiple recipients and create custom program configurations. Leverage a single API or portal-driven integration to ease implementation and create tailored consumer experiences.

Built-In Business Services

Simplify compliance, help mitigate risk and build loyalty. Let us manage the complexities that come with remaining compliant and securing digital payouts. You can focus on stayng connected to your employees and customers.

Security & Fraud

Tokenize payment data and authenticate recipients to help protect consumer data and fight frudsters.

Compliance Services

KYC, AML, OFAC, bad actor screening, and card industry blacklist filter services help mitigate risk.

Communications

Configure communication preferences, messages and branding seen by your customers and employees

Tell Us Your Vision. We Can Build a Solution.

We will work with you to understand your business needs and show you how to best leverage our solutions to make your vision a reality.

Digital Disbursement Ideas and Resources

this link will open in new window.Global Digital Commerce

Fiserv and State Farm Speed Fire and Auto Claim Payments with Digital Payout Solution

Global Digital Commerce

Adapting to a New Normal: Insurers Prioritize Digital Engagement to Deliver Safety and Convenience

Global Digital Commerce

How Hospitals are Managing Healthcare Payments

Global Digital Commerce

Betting on a Digitally-Enabled Future Beyond COVID-19

Global Digital Commerce

Digital Payouts Checklist

Global Digital Commerce

Meeting Expectations Through Digital Disbursements

Sources: 1. Client provided data. 2. Fiserv data. 3. Payout times may vary. 4. Aite Group. 5. Fiserv and client provided data.