Buy Now Pay Later (BNPL)

BNPL is a type of short-term financing which allows your customers to pay a lender in instalments by the end of a stipulated time period, for their purchases at your outlet.

Merchants benefit from offering an additional type of digital payment acceptance, while customers benefit from a low-cost, transparent, and frictionless financial product that enables lightning-fast access to credit, hassle-free credit approval, disbursement, and tension-free repayment plans.

BNPL also allows customers to split their bills into parts at little to no cost.

How Do You Benefit?

Offer your customers an additional payment option (Buy Now Pay Later)

11 million active users of Buy Now Pay Later

Applicable for small ticket size (INR 500/- – INR 20,000/-)

No additional documentation required, transaction is processed as a regular card transaction

How Do Your Customers Benefit?

01

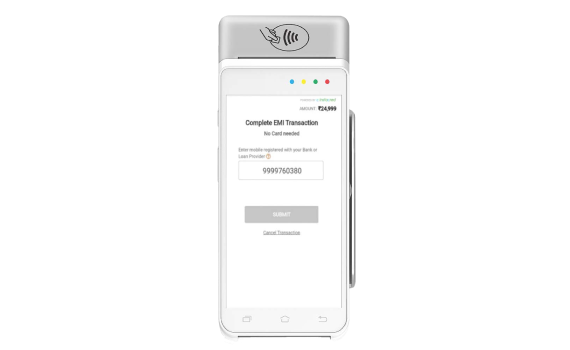

No card or documentation required

02

Transparent & low-cost credit